Consumer Staples Industry Investment Model

Adrian's Comments

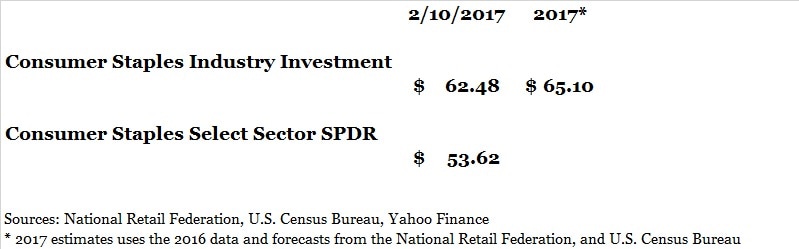

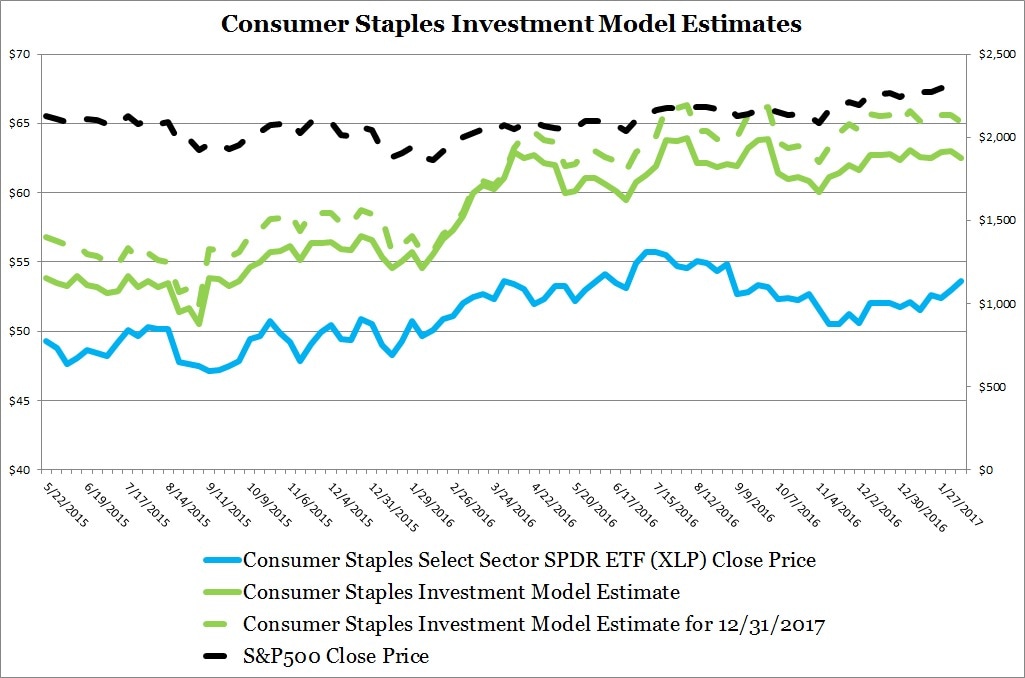

2/18//2017 - The primary driver for the Consumer Staples Industry Investment Model is US wholesaler trade figures and investor sentiment. Investors are currently hiding from global economic uncertainty - Oil and Commodities Crash, weakening Chinese economic conditions, Brexit, and rising interest rates I expect future consumer staples performance to outperform the general stock market.

In terms of other relevant data, the Michigan's Consumer Sentiment Index preliminary reading for February is 95.7 which is equivalent to the 2005 - 2007 average of 86.7. The NRF states that retail sales will grow by 3.4% in 2016, they haven't published a projection for 2017. I use the 3.4% 2016 growth rate.

Finally, I'm in the process of developing a Stock Market Investment Model which will help estimate stock market performance for the Consumer Staples Industry Investment Model.

In terms of other relevant data, the Michigan's Consumer Sentiment Index preliminary reading for February is 95.7 which is equivalent to the 2005 - 2007 average of 86.7. The NRF states that retail sales will grow by 3.4% in 2016, they haven't published a projection for 2017. I use the 3.4% 2016 growth rate.

Finally, I'm in the process of developing a Stock Market Investment Model which will help estimate stock market performance for the Consumer Staples Industry Investment Model.

Model Description

Consumer staples are essential consumer products such as

food, beverages, personal products (toothpaste, shampoo, medicine),

paper products, and etc. The Consumer Staples Industry Investment Model

estimates the price of the Consumer Staples Select Sector SPDR ETF

(XLP) which is an index fund that holds consumer staples retailers in

the S&P 500 Index. Household names such as Walmart, Walgreens, and

Pepsi comprise a large part of the index.

The model will help the general investing public make informed investment decision primarily with the Consumer Staples Select Sector SPDR ETF (XLP) and secondarily with the consumer staples industry and member stocks.

The Consumer Staples Industry Investment Model Prototype is built with the following data:

The model will help the general investing public make informed investment decision primarily with the Consumer Staples Select Sector SPDR ETF (XLP) and secondarily with the consumer staples industry and member stocks.

The Consumer Staples Industry Investment Model Prototype is built with the following data:

- Merchant Wholesaler Sales (1999 - 2014)

- Merchant Wholesaler Inventories (1999 - 2014)

- Stock Market Performance (1999 - 2014)

Model Strengths and Weaknesses

Strengths

- High Regression Correlation

- Good Backtesting Results

- Straightforward Model

- Significant Misses in the late 1990s and early/mid 2000s

- Merchant Inventory Data not statistically significant during backtesting period

Future Updates/Enhancements

- Look into significant misses in the late 1990s and early/mid 2000s.

- Review historical merchant wholesaler inventory data to see if there is a better fit.

- Find a better way to forecast merchant wholesaler inventory data.

- Develop a model to help forecast stock market performance.

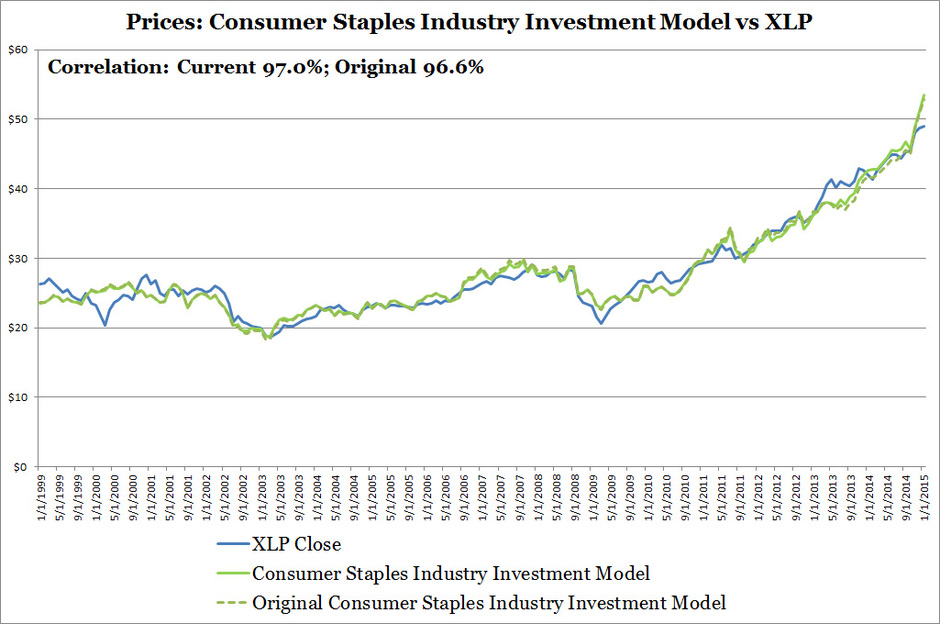

Historical Price: Consumer Staples Industry Investment Model vs XLP

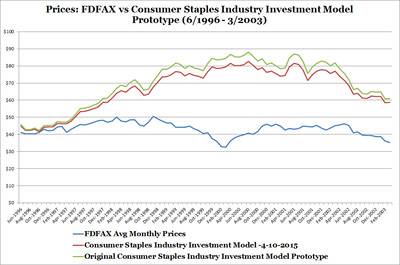

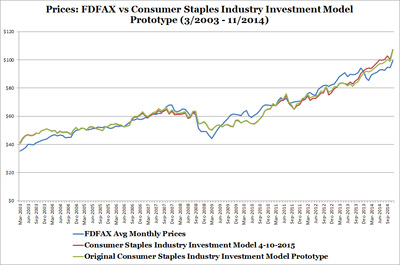

The U.S. Census Bureau revised merchant wholesaler sales and inventory data based on their 2013 Wholesale Trade Survey and preliminary results from the 2012 Economic Census. The above chart shows how estimates from Consumer Staples Industry Investment Model with revised merchant wholesaler data versus the original model and XLP's price. Both models have very high correlations. Correlation in a nutshell measures model accuracy, the larger the number the better. The U.S. Census Bureau revised merchant wholesaler sales and inventory data based on their 2013 Wholesale Trade Survey and preliminary results from the 2012 Economic Census.The U.S. Census Bureau revised merchant wholesaler sales and inventory data based on their 2013 Wholesale Trade Survey and preliminary results from the 2012 Economic Census.The U.S. Census Bureau revised merchant wholesaler sales and inventory data based on their 2013 Wholesale Trade Survey and preliminary results from the 2012 Economic Census. The U.S. Census Bureau revised merchant wholesaler sales and inventory data based on their 2013 Wholesale Trade Survey and preliminary results fro

Backtesting Results

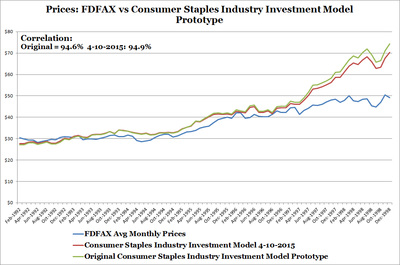

Consumer Staples Industry Investment Model 4-10-2015 is another name for the current model using revised merchant wholesaler data. The three charts highlight that in all periods, besides the dot com era, both the Consumer Staples Industry Investment Model 4-10-2015 and original model provides reasonable estimates of the Fidelity Select Consumer Staples Portfolio (FDFAX). For more details and discussion on the original model backtesting results, please see links below for my prior blog postings.

Model Backtesting Results - Part 1

Model Backtesting Results - Part 2

Model Backtesting Results - Part 1

Model Backtesting Results - Part 2