Please check out my short weekly update on the consumer staples industry I published on my consumer staples page yesterday.

I'm working on 3 articles, the titles and finalized material are subject to change as I finish them:

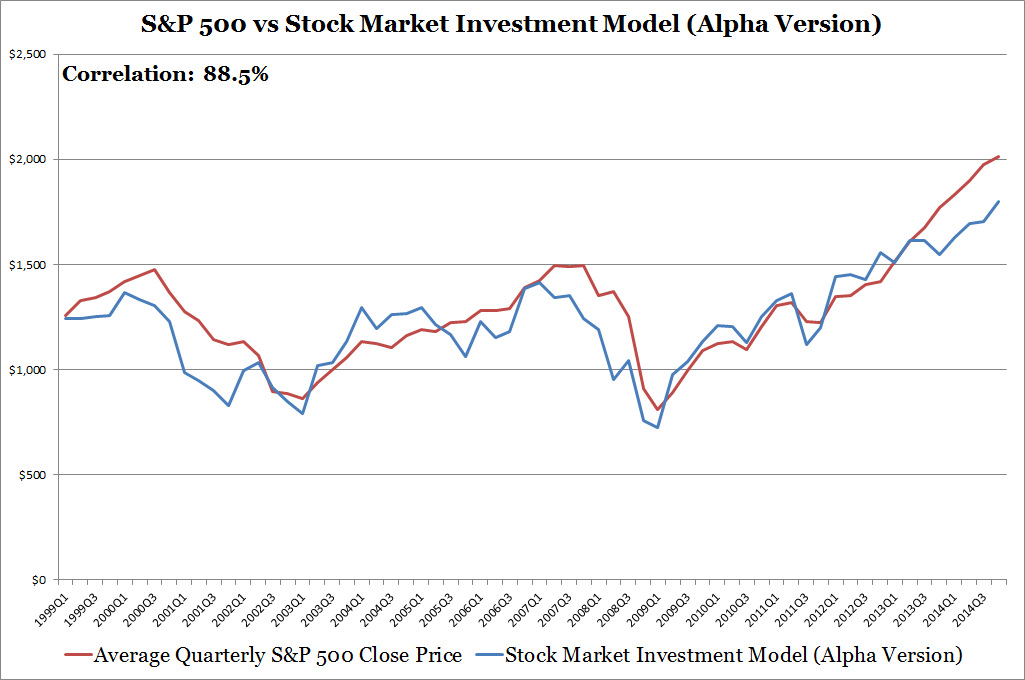

1. Is the S&P 500 Guided By Reason or Emotion? I found an answer to this question when I was building the alpha version of my Stock Market Investment Model. See the small tease below.

I'm working on 3 articles, the titles and finalized material are subject to change as I finish them:

1. Is the S&P 500 Guided By Reason or Emotion? I found an answer to this question when I was building the alpha version of my Stock Market Investment Model. See the small tease below.

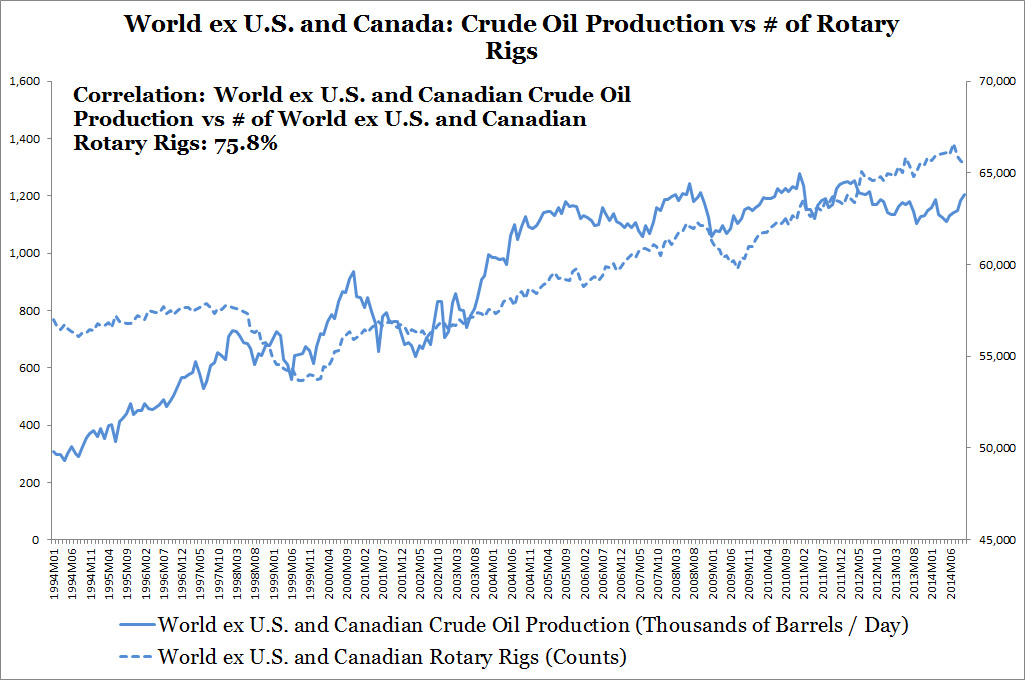

2. Energy Industry Weekly Update - U.S., Canada, Rest of the World Rig Count and Production. The article is 60% done. I'm pushing it for next week since I already have an energy industry article published this week. I'm teasing the below chart.

3. Is The Consumer Staples Industry Just Spinning My Wheels? Lately the Consumer Staples Select Sector SPDR ETF (XLP) has been stuck trading in the $47 to $50 range. Is this trend going to persist? I intend to make this a beefier consumer staples article compared to my weekly updates I previously published. I don't have a chart to tease this topic, but I do have a Yahoo Finance screenshot.

This week I started a mailing list. I encourage you to sign up either on my homepage or my journal page to get blog post notifications by email.

Below is my outstanding to-do-list in order of priority:

I will be time constrained for the next two weeks. Wish I could dedicate more time to thinning down my list. But I will try my best to keep the new content coming.

Below is my outstanding to-do-list in order of priority:

- Build the Stock Market Investment Model

- Finish building the Consumer Discretionary Industry Investment Model

- Investigate why the price estimate of my Energy Industry Investment Model is much lower than the Energy Select Sector SPDR ETF's (XLE) price. I'm looking for evidence to support my hypothesis that dividend investors are propping up energy industry stocks.

- Investigate dot com era, dot com crash, and subsequent recovery effects on both the energy and consumer staples industry investment models

- Investigate why merchant wholesaler inventory levels affects consumer staples industry stocks. I suspect two reasons: higher merchant wholesaler inventory levels equate to higher profit margins for consumer staples retailers or inventory levels is a result of future sales expectations.

- Write an article about lessons I learned from Mohegan Sun casino.

I will be time constrained for the next two weeks. Wish I could dedicate more time to thinning down my list. But I will try my best to keep the new content coming.

RSS Feed

RSS Feed