What are consumer staples? They are essential consumer products such as food, beverages, personal products (toothpaste, shampoo, medicine), paper products, and etc. The Consumer Staples Industry Investment Model estimates the price of the Consumer Staples Select Sector SPDR ETF (XLP) which is an index fund that holds consumer staples retailers in the S&P500 Index. Household names such as Walmart, Walgreens, and Pepsi comprise a large part of the index.

When the model is fully developed it will be posted on InvestModels.com's Consumer Staples page under Industry Investment Models. The model will help the general investing public make informed investment decision regarding primarily the Consumer Staples Select Sector SPDR ETF (XLP) but secondarily the consumer staples industry and member stocks.

The Consumer Staples Industry Investment Model Prototype is built with the following data:

The earlier version of the Consumer Staples Industry Investment Model (v1) is less accurate than the prototype uses the following data:

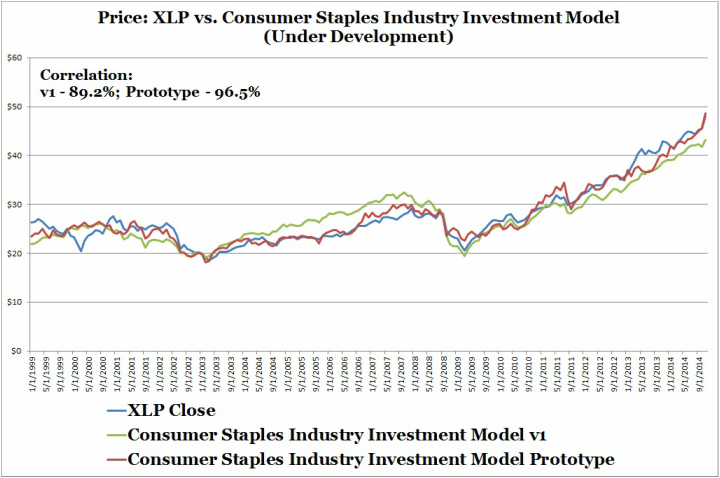

The below chart shows the actual XLP price versus estimates from both the v1 and prototype model. Correlation in a nutshell measures model accuracy, the larger the number the better.

When the model is fully developed it will be posted on InvestModels.com's Consumer Staples page under Industry Investment Models. The model will help the general investing public make informed investment decision regarding primarily the Consumer Staples Select Sector SPDR ETF (XLP) but secondarily the consumer staples industry and member stocks.

The Consumer Staples Industry Investment Model Prototype is built with the following data:

- Wholesaler Sales (1999 - 2014)

- Wholesaler Inventories (1999 - 2014)

- Stock Market Performance (1999 - 2014)

The earlier version of the Consumer Staples Industry Investment Model (v1) is less accurate than the prototype uses the following data:

- Retailer Sales (1999 - 2014)

- Stock Market Performance (1999 - 2014)

The below chart shows the actual XLP price versus estimates from both the v1 and prototype model. Correlation in a nutshell measures model accuracy, the larger the number the better.

Next Steps

The next stage of model development is to backtest the prototype or in other words verify the accuracy of the model using a different time set of historical data (primarily early 1990s). This involves picking another ETF or mutual fund's price that is active in the early 1990s and compare model estimates with historical inputs of wholesaler sales, wholesaler inventories, and stock market performance.

If the backtest is successful I will have the confidence to have everyone use it and look into enhancing it with additional industry forecasts like I do with the Energy Industry Investment Model and its integration with the U.S. Energy Information Administration's 2015 and 2016 forecasts.

The next stage of model development is to backtest the prototype or in other words verify the accuracy of the model using a different time set of historical data (primarily early 1990s). This involves picking another ETF or mutual fund's price that is active in the early 1990s and compare model estimates with historical inputs of wholesaler sales, wholesaler inventories, and stock market performance.

If the backtest is successful I will have the confidence to have everyone use it and look into enhancing it with additional industry forecasts like I do with the Energy Industry Investment Model and its integration with the U.S. Energy Information Administration's 2015 and 2016 forecasts.

If you find this blog entry informative please click the FaceBook or Twitter "LIke" buttons below. Thanks.

RSS Feed

RSS Feed