*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

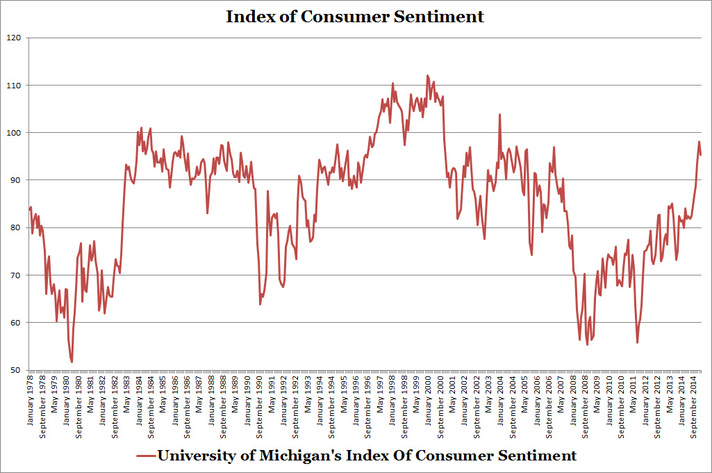

According to the University of Michigan's Index of Consumer Sentiment, consumers are feeling very optimistic. But are they partying like it's 1999 great? Find the answer in the exhibit below.

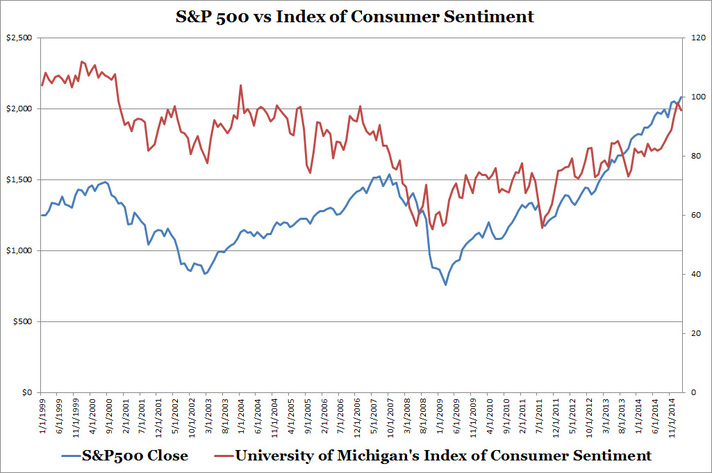

Although not quite the levels of 1999 consumers are still partying like early 2007. The index has been above 90 since December 2014 which is a bullish sign for consumer purchases and consumer staples stocks. The exhibit below shows the stock market also loosely follows the Index of Consumer Sentiment. This winning combination of increasing consumer sales and high stock market values boost consumer staples stocks.

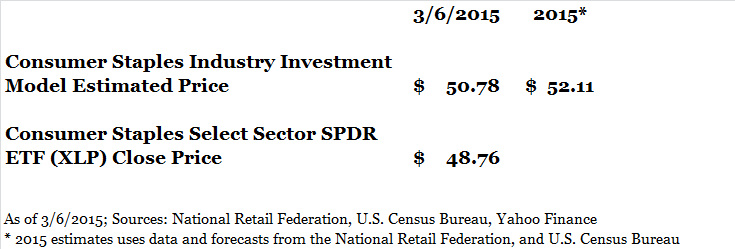

This week, the Consumer Staples Select Sector SPD ETF (XLP) dropped from $50.01 to $48.76 as shown in the below exhibit. This is from a combination of last week's announcement of rising minimum wage for retail workers from Wal-Mart (WMT) and TJX Companies (TJX) which puts pressure on operating costs for the entire retail industry, and this week's stock market drop which is primarily attributed to investor worry that the Feds will increase interest ratesthe Feds will increase interest ratesthe Feds will increase interest ratesthe Feds will increase interest ratesthe Feds will increase interest rates because of a record high February jobs report . My Consumer Staples Industry Investment Model estimates the current price of XLP to be $50.78 and the year end price to be $52.11. The model takes into consideration current levels of merchant wholesaler sales, merchant wholesaler inventories, and stock market performance.

Due to the lack of weekly data and relative price stability of consumer staples stocks, I will publish future blog update whenever there are noteworthy changes. However, I will continue to provide brief weekly updates on my website's Consumer Staples Industry Model's page.

RSS Feed

RSS Feed