*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

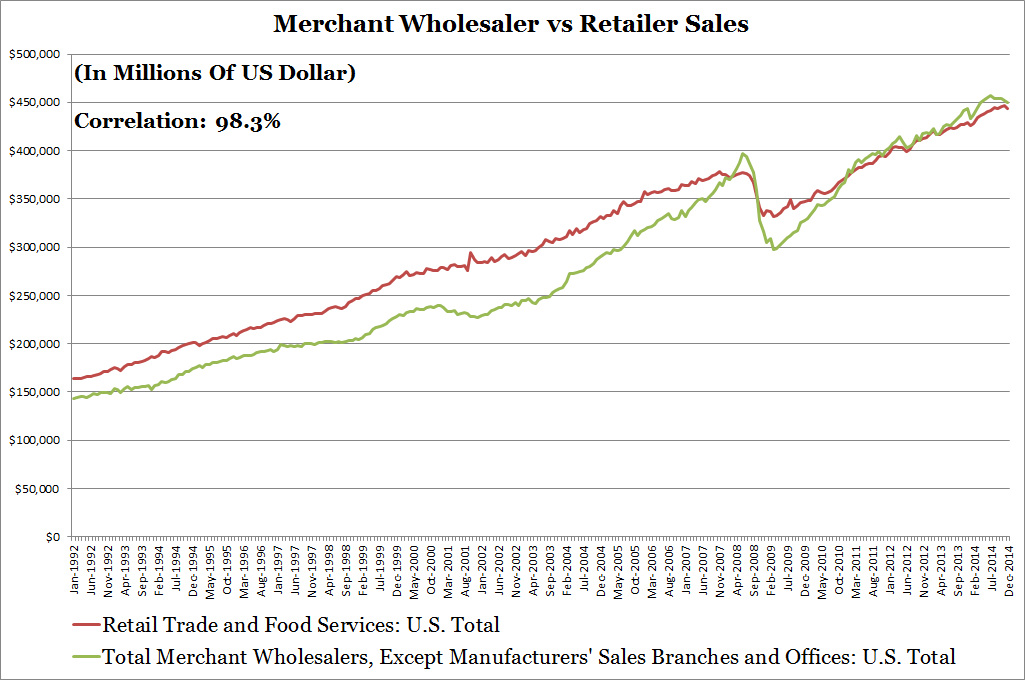

The chart below shows that merchant wholesaler sales are highly correlated with retailer sales but with slightly more volatility. When I modeled the Consumer Staples Select Sector SPDR ETF's (XLP) close prices I found out that its correlation with merchant wholesaler sales is 81.6% versus 79.2% with retailer sales. This higher sensitivity is because the consumer staples industry is populated with large companies who have operations more similar to a merchant wholesaler rather than a retailer. Wal-Mart, Costco, CVS, and Walgreens buy directly from manufacturers, therefore acting as their own wholesaler. Kimberly-Clark, Clorox produce their own products and sell in bulk to wholesalers and retailers. I haven't dug deeply into manufacturer data yet, it's possible consumer staples companies are even more correlated with manufacturer than wholesaler data.

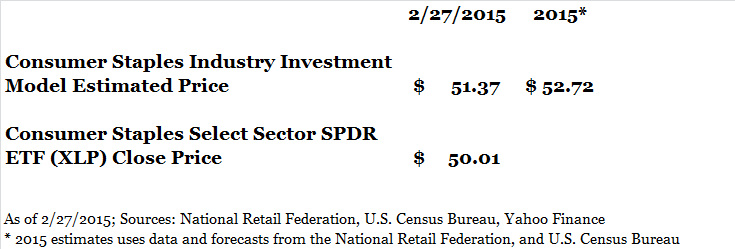

The Consumer Staples Select Sector SPDR ETF (XLP) inched up to $50.01 from $49.60. Besides new stock market data there isn't any updated industry data points for the Consumer Staples Industry Investment Model (see chart below). The model's price estimate moved down slightly from $51.48 last week to $51.37. Based on current levels of merchant wholesaler data, XLP is fully priced at $50.01. For 2015, the National Retail Federation (NRF) projects retail sales excluding automobiles, restaurants, and gas stations will rise 4.1%, however, the Consumer Staples Industry Investment Model says that despite NRF's positive forecast XLP is also fully priced for 2015. I used a retailer sales forecast to model results because I haven't found a good source for wholesaler sales. Retailer sales is a good proxy for wholesaler sales because of their 98.3% correlation.

RSS Feed

RSS Feed