In my last consumer staples post I stated that a Consumer Staples Industry Investment Model prototype has been developed. Now I have the opportunity to backtest the model. This is a statistical method to test a model's accuracy by feeding a data set from a different sample to see if model results behave correctly.

In this situation we are feeding three data sets:

Ideally, model results will be compared with the Consumer Staples Select Sector SPDR ETF's (XLP) average monthly prices from 1992 to 1998 because the model was developed with the ETF using data from 1999 to 2014 but XLP didn't exist until December 1998. Therefore, I will use Fidelity's Select Consumer Staples Portfolio's (FDFAX) average monthly prices which is a mutual fund that has been around since 1985.

FDFAX won't be as great of a fit as XLP but the similarities outweigh the differences:

Similarities:

Differences:

Let me quickly explain the difference between active and passive management. Active management involves a dedicated team of analysts, managers, and computers that strive for an investment objective. For FDFAX, their goal is to select consumer staples company stocks that will appreciation in value in contrast to a passively managed fund like XLP which simply tracks a consumer staples index.

The potential benefit of active management is investment outperformance relative to an index fund but with two disadvantages. First, the cost is much higher than a passively managed fund. FDFAX's latest prospectus states an annual fee of .79% of assets under management while XLP's is .16% of assets under management. A passively managed fund typically employs a small team of managers and computers. Second, there is a risk of investment underperformance from poor management decisions. One way this can be seen is in increased price volatility. I will explain this further down.

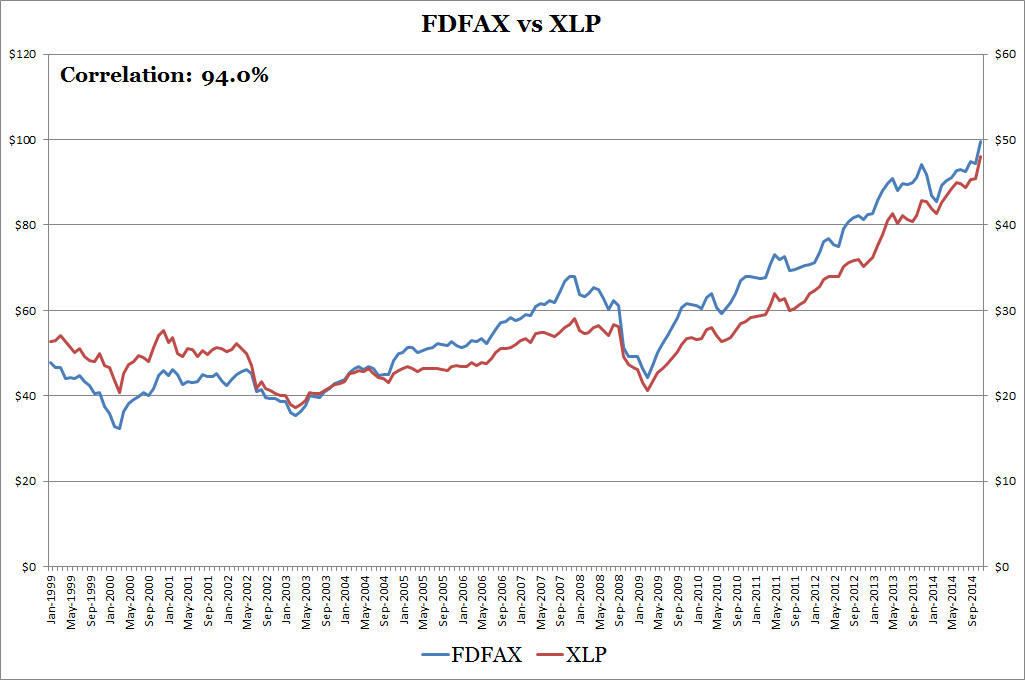

The below chart visually shows prices of FDFAX and XLP. First, you will notice that both funds move in similar directions. This is confirmed with its 94.0% correlation. A 100% correlation means that two variables always move in the same direction.

In this situation we are feeding three data sets:

- Stock Market Performance (1992 - 1998)

- Wholesale Sales (1992 - 1998)

- Wholesale Inventory (1992 - 1998)

Ideally, model results will be compared with the Consumer Staples Select Sector SPDR ETF's (XLP) average monthly prices from 1992 to 1998 because the model was developed with the ETF using data from 1999 to 2014 but XLP didn't exist until December 1998. Therefore, I will use Fidelity's Select Consumer Staples Portfolio's (FDFAX) average monthly prices which is a mutual fund that has been around since 1985.

FDFAX won't be as great of a fit as XLP but the similarities outweigh the differences:

Similarities:

- Invested in Consumer Staples Industry

- Diversified - Holds many companies

- Open to the general public for share purchase

Differences:

- Active versus Passive Management

- Benchmarked to different target indices

Let me quickly explain the difference between active and passive management. Active management involves a dedicated team of analysts, managers, and computers that strive for an investment objective. For FDFAX, their goal is to select consumer staples company stocks that will appreciation in value in contrast to a passively managed fund like XLP which simply tracks a consumer staples index.

The potential benefit of active management is investment outperformance relative to an index fund but with two disadvantages. First, the cost is much higher than a passively managed fund. FDFAX's latest prospectus states an annual fee of .79% of assets under management while XLP's is .16% of assets under management. A passively managed fund typically employs a small team of managers and computers. Second, there is a risk of investment underperformance from poor management decisions. One way this can be seen is in increased price volatility. I will explain this further down.

The below chart visually shows prices of FDFAX and XLP. First, you will notice that both funds move in similar directions. This is confirmed with its 94.0% correlation. A 100% correlation means that two variables always move in the same direction.

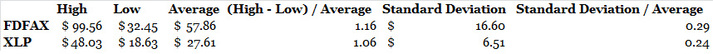

Second, regarding price volatility, you can somewhat see that FDFAX prices are more volatile than XLP's with FDFAX taking off during the late 2000s and the last couple of years but underperforming during the dot com boom of the late 1990s and early 2000s. I calculated a few figures below to better describe volatility. You can't readily see this with high, low, and averages. But it is more evident in two ratios: standard deviation / average and (high - low ) / average which indicates that FDFAX is a bumpier ride. Standard deviation according to Investopedia.com "is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation."

FDFAX is a sufficient comparison partner to gauge model backtesting results. After I finalize my results run, I will post results and discuss.

RSS Feed

RSS Feed