*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

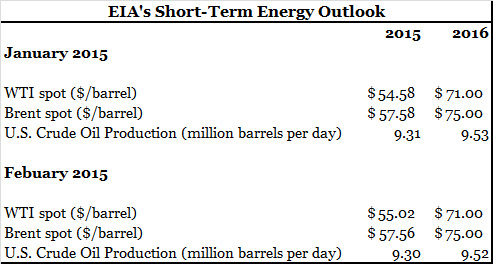

EIA's Short-Term Energy Outlook released this week. You can see from the chart above that crude oil prices and production barely budged from last month making this updated EIA report meaningless for changes in some of the Energy Industry Investment Model's inputs. I was expecting the recent rise in crude oil prices and continued supply increases to change EIA's 2015 and 2016 outlook.

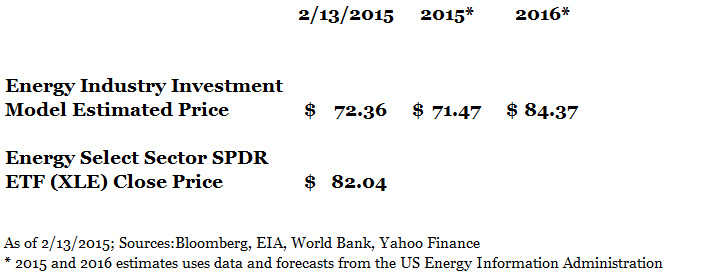

Two things materially affected model results this week: crude oil prices moving into the high $50/barrel range and record high stock market prices. The Energy Industry Investment Model increased the current price estimate from $66.97 last week to $72.36 this week versus the Energy Select Sector SPDR ETF's (XLE) move from $79.82 to $82.04. Please visit the Energy Industry Investment Model's page for the latest commentary, model description, and backtesting results.

RSS Feed

RSS Feed