*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

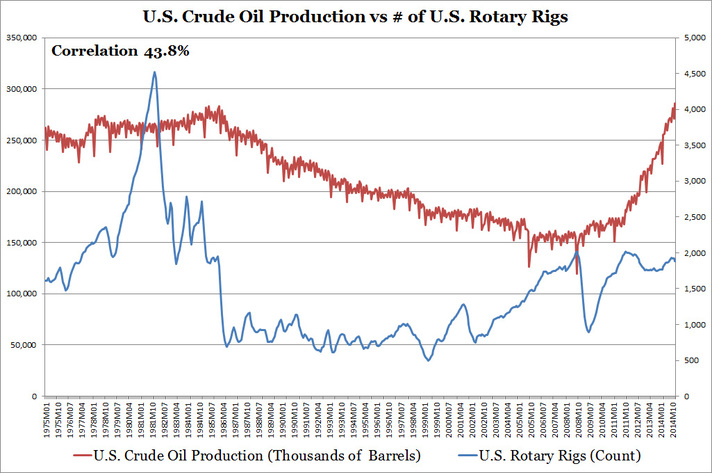

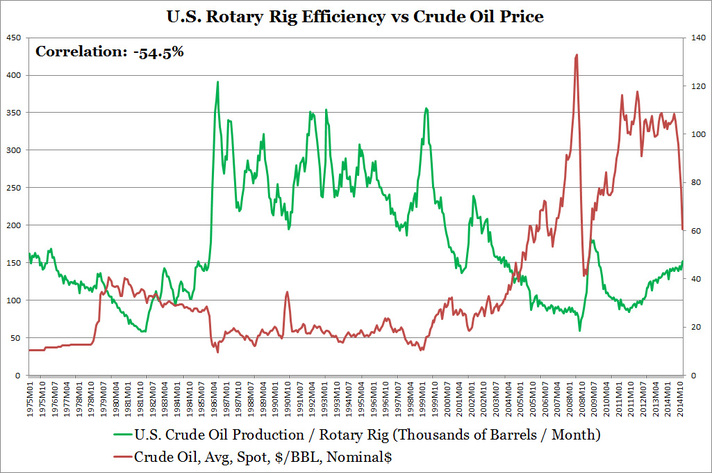

It would seem reasonable to assume that fewer rotary rigs drilling would equate to lower crude oil production. The first chart below shows U.S. production versus rotary rig count. At first glance, the loose correlation of 43.80% between rotary rig count and crude oil production doesn't seem very related. The other missing piece, shown in the second cart, is rig efficiency as represented by crude oil production per rig in the second chart. Efficiency is inversely related to recessionary times and oil price collapses. This makes sense as energy companies idle rigs and crew to save money and focus on pumping more oil from existing rigs. Because rig efficiency and the number of rigs is volatile and not as highly correlated with oil production, investors should focus on crude oil production data for their analysis of the energy industry.

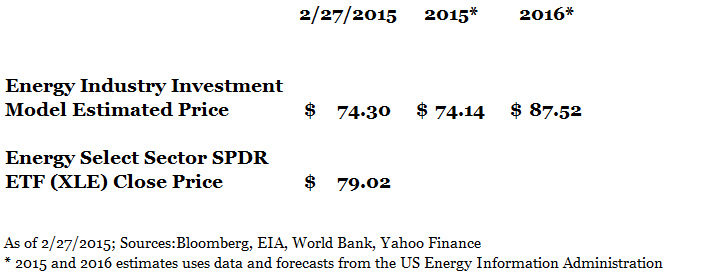

This week, the EIA released December 2014 data on crude oil and petroleum products production with crude showing 5% and petroleum products showing 8% growth from November 2014. Using this new data, the Energy Industry Investment Model estimates that the current price of Energy Select Sector SPDR ETF (XLE) is worth $74.30 up from $71.23 last week. Both the 2015 and 2016 estimated prices went up about $3.

Oil prices are currently around $55/barrel with crude oil production at almost 9.3 milion barrels/day from EIA's 2/20/2015 weekly crude oil production data. I consider XLE to be slightly overvalued now and for the rest of the year. For 2016, if EIA's estimate of $71/barrel WTI and $75/barrel Brent crude oil prices and 9.5 million barrels/day crude oil production come true, my model expects XLE to be at $87.52. Investors planning on holding XLE until 2016 should buy if they trust EIA's outlook.

RSS Feed

RSS Feed