*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

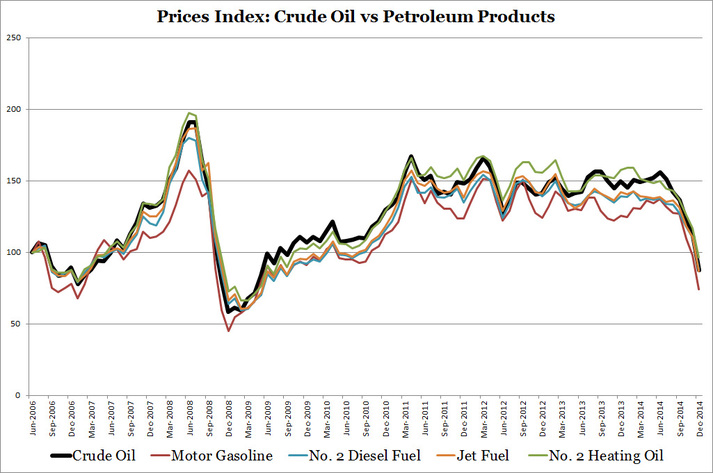

Refineries turn crude oil into finished petroleum products like motor gasoline, diesel fuel, and jet fuel. Today we are going to look at how closely four petroleum products track crude oil prices. The chart below shows that truth. Over a long period the four major petroleum products track very closely with crude oil prices. I indexed prices to June 2006 at 100.

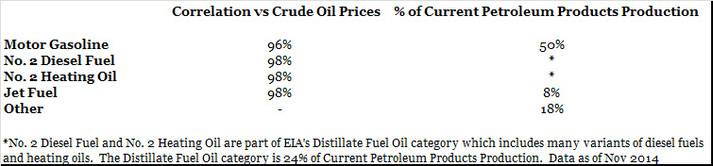

Price correlations shown below are close to 100%. The most important petroleum product investors should be paying attention to is motor gasoline which accounts for 50% of all petroleum products production. The next largest category is EIA's distillate fuel oil which is 24% of production. This group includes many variants of diesel fuel and heating oil. I used the No. 2 Diesel Fuel and No. 2 Heating Oil prices to represent the distillate fuel oil group.

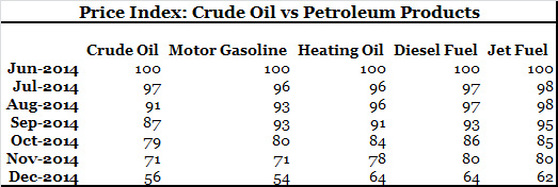

Digging deeper into current history (chart below) we see that motor gasoline prices follow the drop in crude oil prices in magnitude. Historical correlations don't tell everything. What is unique is the slower price declines of the other petroleum products relative to crude oil. This may help refineries see a smaller profit dip as their input costs (crude oil) drop more than their output revenues (petroleum products). This affects integrated oil companies in the Energy Select Sector SPDR ETF (XLE) such as Exxon Mobil (XOM) and Chevron (CVX). Perhaps they may beat earnings expectations next quarter.

Knowing that not all petroleum products have the same price elasticity to changes in crude oil could make a difference in smaller energy companies which may be more focused on refining and selling specific types of petroleum products. As investors we need to remain vigilant in our investments research. While it seems like common sense that prices of crude oil and petroleum products would move together, but when the environment suddenly changes our first assumption is that they will move proportionately but in this crude oil price collapse they don't.

RSS Feed

RSS Feed