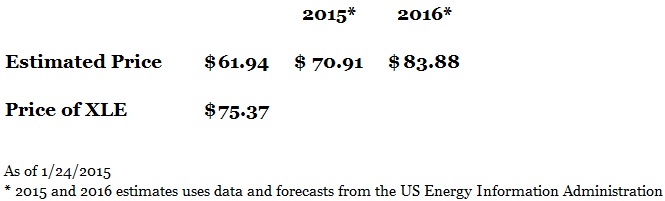

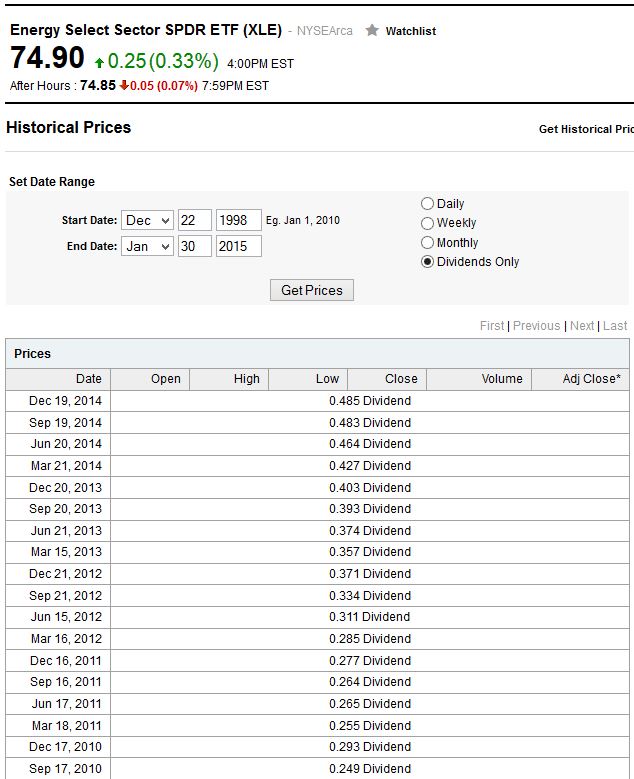

As oil prices fall into the $40 - $50 a barrel range, the Energy Industry Investment Model predicts a price of $61.94, but XLE's closing price on 1/24/2015 is $75.37. At the moment I'm entertaining two possibilities. First, dividend investors are buying. XLE is filled with mega cap oil companies such as Exxon Mobil, Chevron, ConocoPhillips that pay a steady dividend. I suspect that investors interested in cash dividends or equity income would be enticed to purchase these stocks to their investment portfolio. To dividend investors, there has just been a price decline and no dividend cuts.

In ConocoPhillips' 2014 earnings release today, CEO Ryan Lance seems to know that dividend investors are an important segment of the company's share ownership. It quoted that his priorities "are to protect [ConocoPhillips'] dividend and base production, stay on track for cash flow neutrality in 2017, and preserve future opportunities." In order to do that they have reduced future capital expenditures. Other companies in the Energy Select Sector SPDR ETF (XLE) have also announced layoffs and capital expenditure cuts.

The question now is whether the price of oil and other energy products will stay low long enough to threaten cash dividends. If that happens, I project XLE's price to move a lot closer to my Energy Industry Investment Model's estimates.

In ConocoPhillips' 2014 earnings release today, CEO Ryan Lance seems to know that dividend investors are an important segment of the company's share ownership. It quoted that his priorities "are to protect [ConocoPhillips'] dividend and base production, stay on track for cash flow neutrality in 2017, and preserve future opportunities." In order to do that they have reduced future capital expenditures. Other companies in the Energy Select Sector SPDR ETF (XLE) have also announced layoffs and capital expenditure cuts.

The question now is whether the price of oil and other energy products will stay low long enough to threaten cash dividends. If that happens, I project XLE's price to move a lot closer to my Energy Industry Investment Model's estimates.

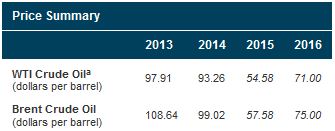

The second possibility, investors expect the price of oil to rebound. This is supported by the U.S Energy Information Administration's (EIA) estimates for Brent and WTI oil prices. Therefore, the Energy Industry Investment Model predicts that XLE will rise to $83.88 in 2016.

RSS Feed

RSS Feed