*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

Recessions are scary events for stock investors. There are many ways investors can blunt a recession's impact on a portfolio such as hedging with short stocks, buying puts, holding cash, buying treasuries. Today I'm going to look at how effective it would be to invest in consumer staples companies during trying times. I'm using the Consumer Staples Select Sector SPDR ETF (XLP) as my proxy for the consumer staples industry. This ETF tracks an index of companies that provide consumer essential products such as food, beverages, tobacco, personal hygiene products, and medicinal products. The ETF is heavily weighted towards the industry's largest companies such as Wal-Mart, Coca-Cola, Proctor & Gamble. You can find additional details on the ETF's official page.

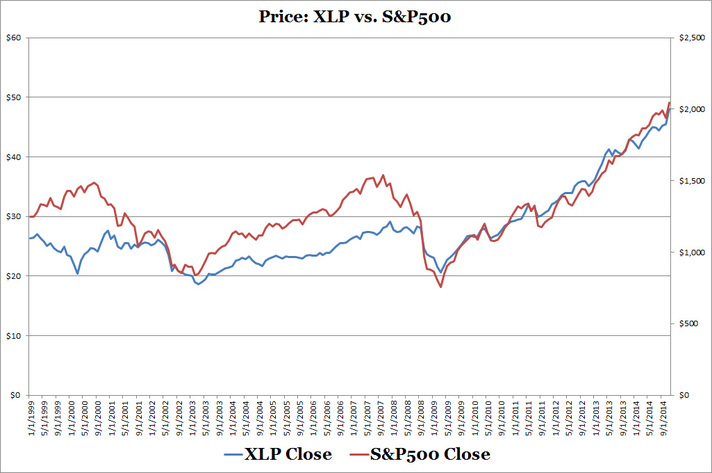

The chart below plots prices of XLP versus the S&P500 Stock Index. It shows three distinct periods.

The chart below plots prices of XLP versus the S&P500 Stock Index. It shows three distinct periods.

- 1999 - 2002: XLP moved in the opposite direction during the boom but together during the crash.

- 2003 - 2009: XLP trailed the index during the boom but dropped less during the crash.

- 2009 - 2014: XLP moved with the index.

Based on the data, XLP performs poorly or trails during boom periods but provides price stability during downturns. You may wonder why both XLP and the S&P500 Index move together after 2009. My theory is that investors scarred by the Great Recession would likely invest in safer companies such as consumer staples companies that are typically household names, profitable, and dividend paying. This investor focus and need for financial security would increase the price and influence of these safer companies in the S&P500 Index. As a result both XLP and the S&P500 Index will move together. For instance during the dot com era internet, techology, and software companies dominated dragging the S&P500 Index for the same ride to record price levels.

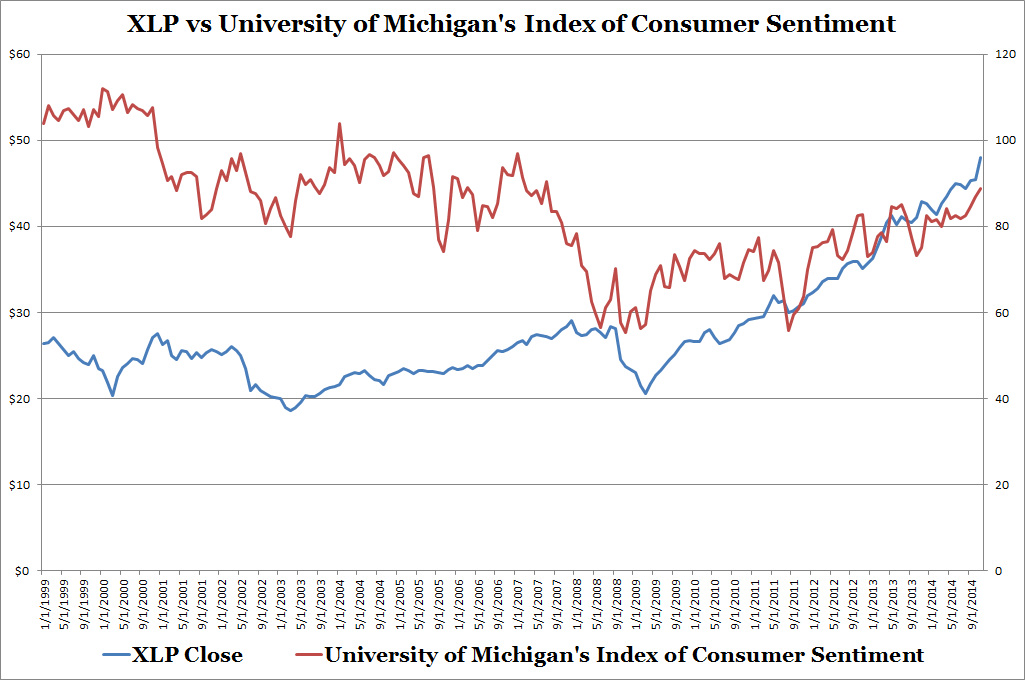

During recessions consumer sentiment falls significantly and low levels of consumer sentiment is a boom for consumer staples companies. I illustrate this in the chart below with XLP versus the University of Michigan's Index of Consumer Sentiment. Another interesting point is that the Index of Consumer Sentiment is more volatile than XLP's prices. I'm not sure if there is a connection.

During recessions consumer sentiment falls significantly and low levels of consumer sentiment is a boom for consumer staples companies. I illustrate this in the chart below with XLP versus the University of Michigan's Index of Consumer Sentiment. Another interesting point is that the Index of Consumer Sentiment is more volatile than XLP's prices. I'm not sure if there is a connection.

Investors interested in maintaining exposure in the stock market during economic downturns can consider investing in the consumer staples industry due to their lower volatility compared with the general stock market as represented by the S&P500 Index as their relative hedge against falling consumer sentiment. However, investors hoping to avoid the impact of recessions altogether will need to look for counter cyclical investments such as S&P500 puts.

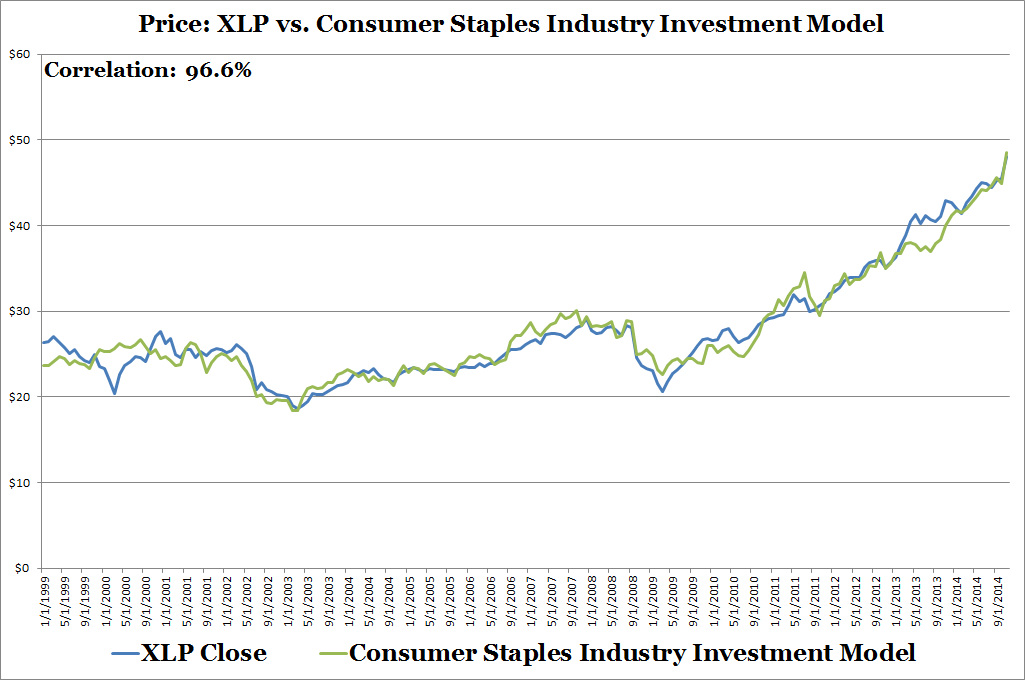

This weekend I will officially introduce my Consumer Staples Industry Investment Model to the world. The model will provide estimates of the Consumer Staples Select Sector SPDR ETF's (XLP) prices giving investors an idea of whether the ETF is under or overvalued. Model results will be posted weekly on my website. Below is a taste of its accuracy. Backtesting results are available in a previous blog entry on my website's journal section.

This weekend I will officially introduce my Consumer Staples Industry Investment Model to the world. The model will provide estimates of the Consumer Staples Select Sector SPDR ETF's (XLP) prices giving investors an idea of whether the ETF is under or overvalued. Model results will be posted weekly on my website. Below is a taste of its accuracy. Backtesting results are available in a previous blog entry on my website's journal section.

RSS Feed

RSS Feed