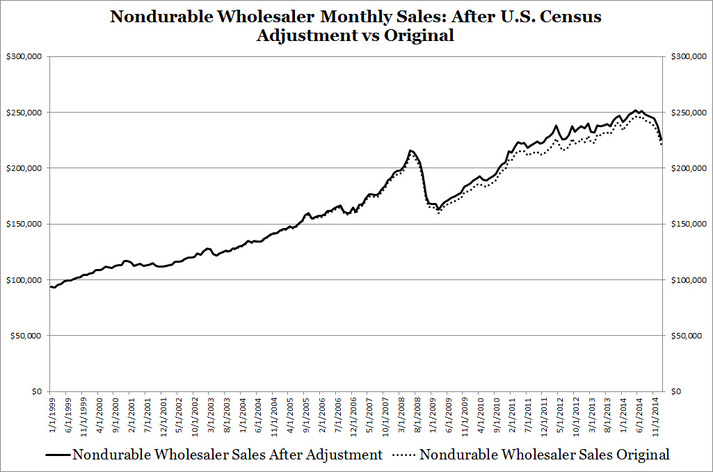

On Sunday, I published my blog: "Is The Consumer Staples Industry Just Spinning My Wheels?". I presented a lot of macroeconomic data from the U.S. Census Bureau and Bureau of Economic Analysis. It took a lot of time to find and compile them, but I think it's good information for me to follow. The blog also used the Consumer Staples Industry Investment Model rebuilt with U.S. Census Bureau adjusted merchant wholesaler data. Here is a visual representation of how the data changed and how the rebuilt vs original models look. It didn't have a material difference on model results.

This week I've also begun reviewing my CFA quantitative methods chapters in preparation for model testing. I've been experimenting on various ways to seasonally adjust the crude oil and petroleum products production data for my Energy Industry Investment Model. A simple moving average is ruled out because it underestimates the magnitude of near term changes in production. Something more sophisticated will be used. I was also able to find someone knowledgeable about statistcis in my network who can guide me if I get stuck.

In the near term I will focus on model testing rather than publishing articles. I'll continue to provide weekly model results on both the Consumer Staples and Energy Industry models on my website.

My outstanding to-do-list in order of priority:

Thank you for your patience.

In the near term I will focus on model testing rather than publishing articles. I'll continue to provide weekly model results on both the Consumer Staples and Energy Industry models on my website.

My outstanding to-do-list in order of priority:

- Energy Industry Investment Model - Fix seasonality in crude oil and petroleum products production

- Finish building the Stock Market Investment Model

- Finish building the Consumer Discretionary Industry Investment Model

- Write an energy industry article

- Investigate why the price estimate of my Energy Industry Investment Model is much lower than the Energy Select Sector SPDR ETF's (XLE) price. I'm looking for evidence to support my hypothesis that dividend investors are propping up energy industry stocks.

- Investigate dot com era, dot com crash, and subsequent recovery effects on both the energy and consumer staples industry investment models.

- Investigate why merchant wholesaler inventory levels affects consumer staples industry stocks. I suspect two reasons: higher merchant wholesaler inventory levels equate to higher profit margins for consumer staples retailers or inventory levels is a result of future sales expectations.

- Write an article about lessons I learned from Mohegan Sun casino.

- Write an article about how to identify stock market tops.

Thank you for your patience.

RSS Feed

RSS Feed