*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

This week, crude oil production and stock levels continue to reach higher while crude oil prices retreat slightly. Two pieces of news this week that will impact petroleum product production going forward are the refinery worker strikes and Exxon Mobil's (XOM) refinery explosion.

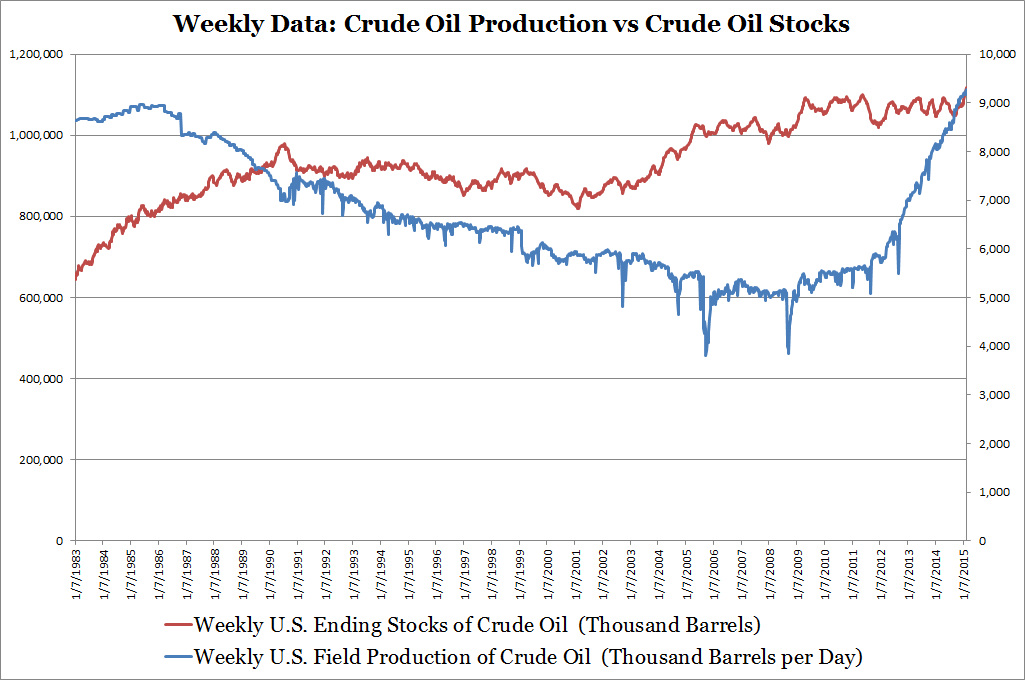

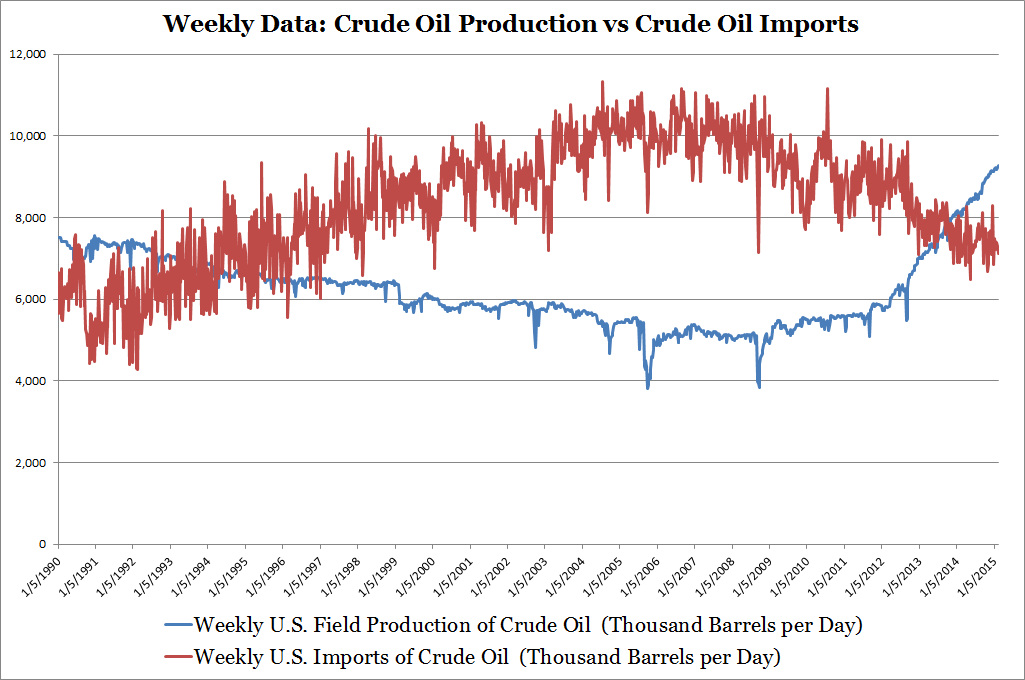

The below two charts show weekly data for crude oil U.S. production, stocks, and imports. Despite the big drop in oil prices of the last few months, U.S. production is still at record highs leading to record high stocks levels. The second chart shows that as U.S. crude production increases the need for imports declines.

The below two charts show weekly data for crude oil U.S. production, stocks, and imports. Despite the big drop in oil prices of the last few months, U.S. production is still at record highs leading to record high stocks levels. The second chart shows that as U.S. crude production increases the need for imports declines.

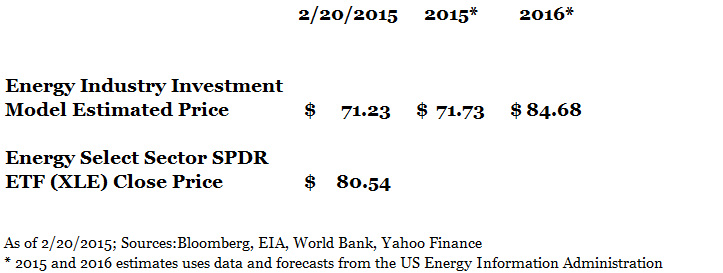

The Energy Select Sector SPDR ETF (XLE) is my proxy for the energy industry. After updating my Energy Industry Investment Model with the latest oil production figures, oil prices, and stock market performance the results below show that XLE's 2/20/2015 closing price is still above my model's estimated price of $71.23. The large gap between my model estimate and XLE's price is because the ETF only dropped a little more than 20% since last summer while oil prices dropped by almost 50%.

EIA predicts that in 2016 oil prices will move up to $71/barrel and U.S. production will increase from this week's almost 9.3 million barrels a day to 9.5 million barrels a day. Using the EIA's estimates as inputs, I project XLE's price will be $84.68 in 2016.

EIA predicts that in 2016 oil prices will move up to $71/barrel and U.S. production will increase from this week's almost 9.3 million barrels a day to 9.5 million barrels a day. Using the EIA's estimates as inputs, I project XLE's price will be $84.68 in 2016.

I recommend investors stay away from XLE as the price is too high given the massive drop in oil price and continued record U.S. oil production and oil stock levels. Even though the EIA's estimates indicate that XLE will be worth $84.68 in 2016, it is notoriously hard to forecast oil prices. Last June as oil began its slide the EIA predicted $90/barrel oil prices in 2015. Also, few analyst expected OPEC's decision in November to not cut oil production. Finally, Investors should conduct extra due diligence when considering investments in individual energy companies.

The effects of the refinery strike and explosion is negative for three members of XLE's portfolio: Marathon Petroleum Corporation (MPC), Tesoro Corporation (TSO), and Exxon Mobil (XOM) but other members of XLE are likely to gain from this situation. Therefore, I didn't adjust model results because it would be hard to predict how these two events might impact the valuation of XLE as a whole.

Feel free to check out my website for more information about my Energy Industry Investment Model and stay tuned for next week's release of model results versus XLE.

RSS Feed

RSS Feed