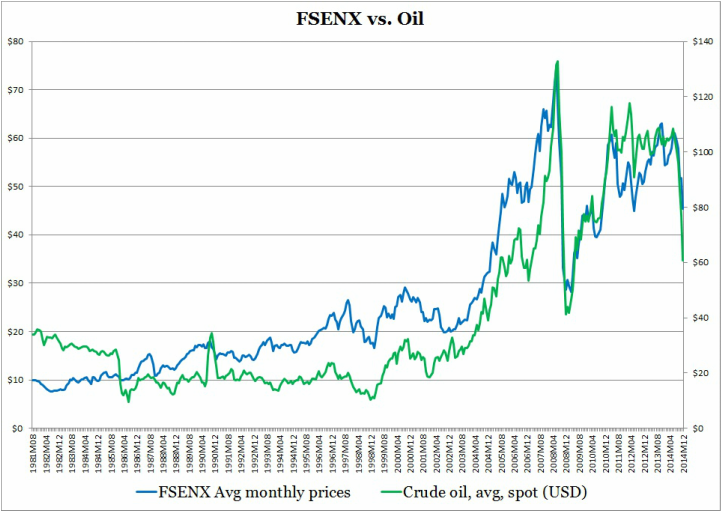

This is a natural question to ask. The answer is no unless the general stock market also collapses. Let me present some evidence. Fidelity's Select Energy Portfolio (FSENX) has been around since 1981. The mutual fund has been around long enough to see a few eras of oil price collapses: the mid 1980s, late 1990s, and the Great Recession of 2007 to 2009. In the FSENX vs Oil chart, you can see how the mutual fund prices track oil prices except during the early 1980s through 2007 where the mutual fund seems to grow faster than crude oil prices.

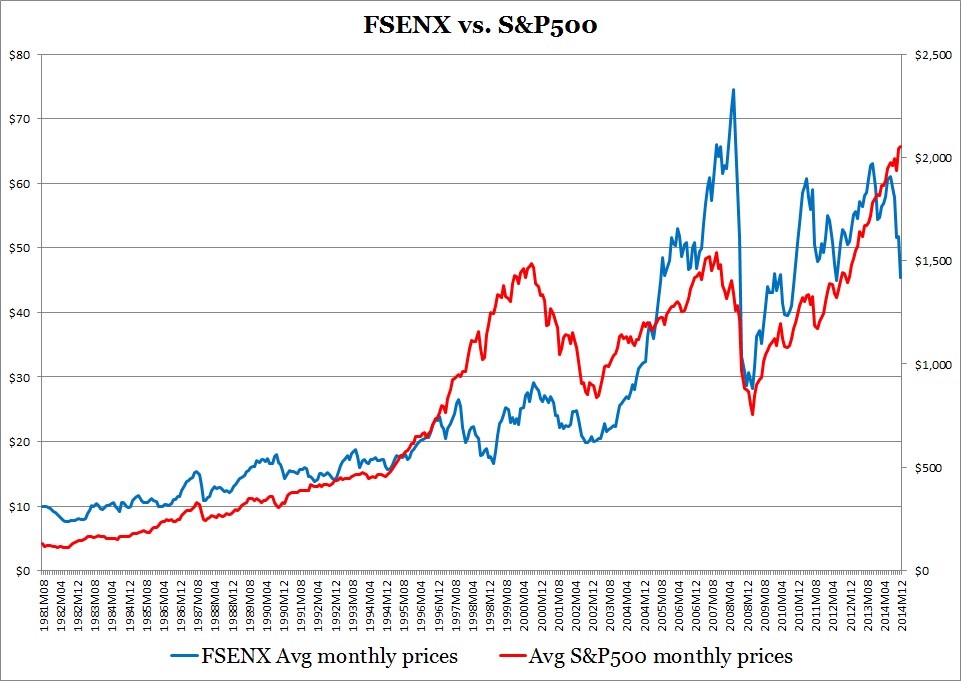

The other important factor to consider is the stock market. The S&P500 stock index is comprised of 500 companies that Standard & Poor's (the index creator) believes is a good representation of the stock market. The below chart shows the disconnect between FSENX's performance can be partially explain with how it tracks the S&P500. The S&P500 is an important barometer for the health of not only the stock market but also the economy.

From the two charts I want to highlight three points:

- During the 1980s and 1990s, oil prices are consistently low and steady; however, FSENX prices increased steadily. This mirrored the S&P500's steady ascent.

- During the dot com boom in the late 1990s and early 2000s, FSENX moved with oil prices, but the gap between FSENX and oil widened slightly which follow the rise in S&P500.

- During the Great Recession, oil, S&P500, and FSENX prices all collapsed together.

One can argue that there are other factors in energy stock performance besides oil prices and S&P500 performance, I believe they are the largest contributors to performance.

Fast forward to the current situation, oil prices have dropped more than 50%. The key difference this time is that the S&P500 continues to rise. Therefore I will state that only the combination of collapsing crude prices and poor stock market performance will sink energy stocks to the pits.

What about the dividend investors and other investors who are waiting for an oil price rebound that I talked about in my 1/29/2015 blog?

Those investors provide price support for energy stocks. Click the button below to view the latest model results updated today based on 1/31/2015. Although the Energy Industry Investment Model is used primarily for the Energy Select Sector SPDR ETF (XLE), its results are also a good indicator of energy stocks as a whole.

Fast forward to the current situation, oil prices have dropped more than 50%. The key difference this time is that the S&P500 continues to rise. Therefore I will state that only the combination of collapsing crude prices and poor stock market performance will sink energy stocks to the pits.

What about the dividend investors and other investors who are waiting for an oil price rebound that I talked about in my 1/29/2015 blog?

Those investors provide price support for energy stocks. Click the button below to view the latest model results updated today based on 1/31/2015. Although the Energy Industry Investment Model is used primarily for the Energy Select Sector SPDR ETF (XLE), its results are also a good indicator of energy stocks as a whole.

RSS Feed

RSS Feed