*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

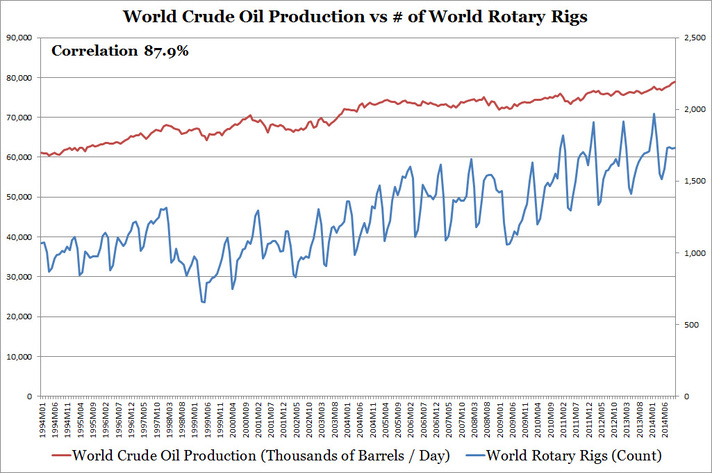

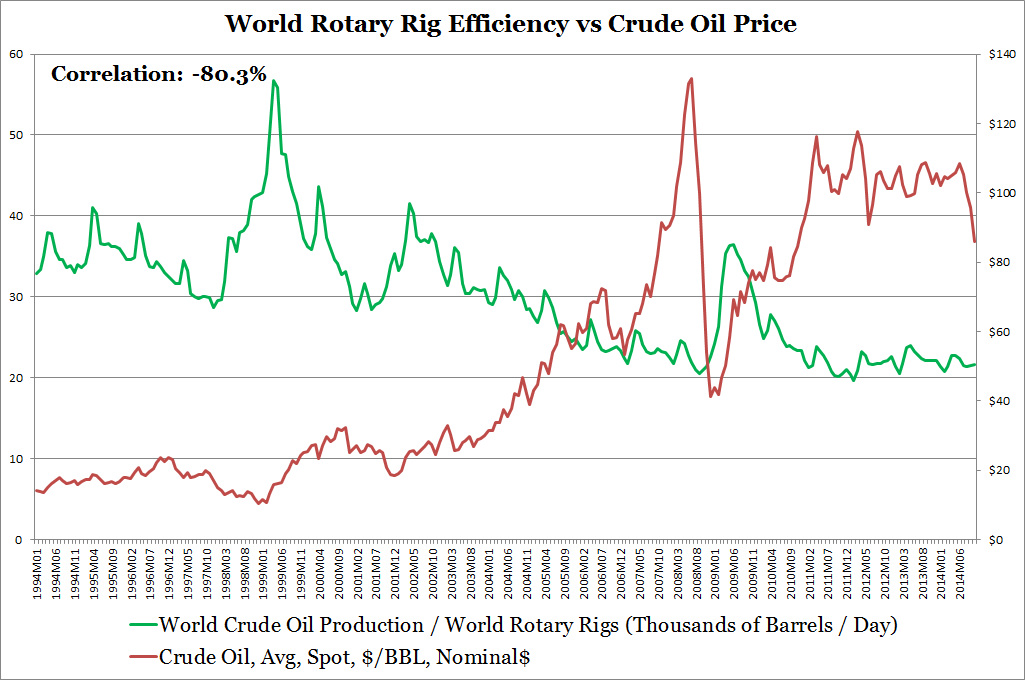

Last week, I looked at how U.S. rotary rig count declines didn't necessarily translate into lower U.S. crude oil production. This week we will look at the same two figures on the world level in the two exhibits below. I'm glad to report a strong correlation between world crude oil production and world rotary rig count. It is also encouraging that world rotary rig efficiency has a strong negative correlation with crude oil price levels. In contrast to U.S. production and rotary rig count, I feel more comfortable using Baker Hughes' rig counts to get an idea of future oil production worldwide.

Baker Hughes reports that world rig count dropped from 3,657 in October 2014 to 2,986 in February 2015, but I only have EIA's world crude oil production till October 2014.

This week in the U.S. energy industry the price of the crude oil remains near the $55/barrel range, while U.S. weekly crude oil production continues breaking records finally breaching 9.3 million barrel/day. My Energy Industry Investment Model estimates that the Energy Select Sector SPDR ETF (XLE) is currently worth $70.03 and will head towards $86.71 in 2016 if EIA's estimate of $71/barrel WTI and $75/barrel Brent crude oil prices and 9.5 million barrels/day crude oil production come true. Last week, the Energy Industry Investment Model estimated a current price of $74.30. This week's decrease is primarily attributed to lower stock market performance as investors worry that record high February job growth will increase the probability that the Feds will increase interest rates.

This week in the U.S. energy industry the price of the crude oil remains near the $55/barrel range, while U.S. weekly crude oil production continues breaking records finally breaching 9.3 million barrel/day. My Energy Industry Investment Model estimates that the Energy Select Sector SPDR ETF (XLE) is currently worth $70.03 and will head towards $86.71 in 2016 if EIA's estimate of $71/barrel WTI and $75/barrel Brent crude oil prices and 9.5 million barrels/day crude oil production come true. Last week, the Energy Industry Investment Model estimated a current price of $74.30. This week's decrease is primarily attributed to lower stock market performance as investors worry that record high February job growth will increase the probability that the Feds will increase interest rates.

RSS Feed

RSS Feed