*Disclosure: I don't hold or plan to trade any of the securities mentioned in this blog within the next 48 hours.

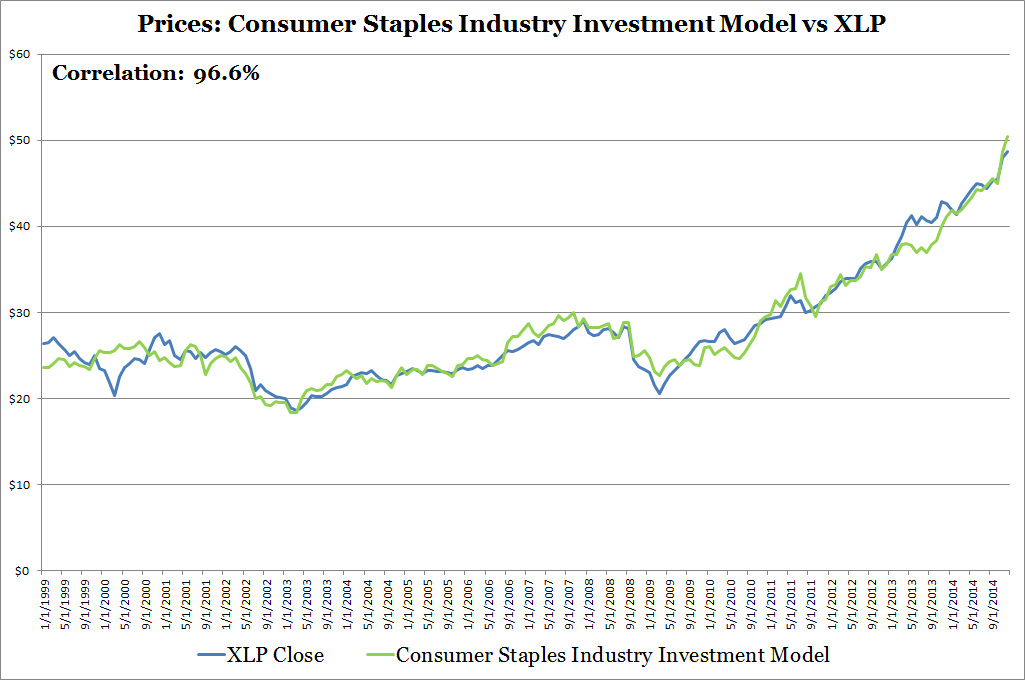

To answer this question my Consumer Staples Industry Investment Model looks at three important data sources: merchant wholesaler sales, merchant wholesaler inventory, and general stock market performance. I compare the model's estimated prices to the Consumer Staples Select Sector SPDR ETF's (XLP) closing prices.

Let's take a quick look at the three data sources in more detail:

Merchant Wholesaler Sales

Industry revenues is major determinant of industry value and performance. I used the U.S. Census Bureau's merchant wholesaler sales data instead of retail sales data. I found that retail sales is a better fit for the consumer discretionary industry.

Merchant Wholesaler Inventory

Changes in inventory levels are an important economic indicator. Another issue with the U.S. Census Bureau's retail sales data is that inventory data is provided only for the aggregate level but not for the sub category level.

General Stock Market Performance

Investor sentiment and economic performance and expectations influence general stock market performance which in turn influence publicly traded consumer staples companies.

Accuracy of the Consumer Staples Industry Investment Model

The below chart shows the higher correlation of the Consumer Staples Industry Investment Model versus XLP. This model also passed a backtest I conducted earlier this month.

Let's take a quick look at the three data sources in more detail:

Merchant Wholesaler Sales

Industry revenues is major determinant of industry value and performance. I used the U.S. Census Bureau's merchant wholesaler sales data instead of retail sales data. I found that retail sales is a better fit for the consumer discretionary industry.

Merchant Wholesaler Inventory

Changes in inventory levels are an important economic indicator. Another issue with the U.S. Census Bureau's retail sales data is that inventory data is provided only for the aggregate level but not for the sub category level.

General Stock Market Performance

Investor sentiment and economic performance and expectations influence general stock market performance which in turn influence publicly traded consumer staples companies.

Accuracy of the Consumer Staples Industry Investment Model

The below chart shows the higher correlation of the Consumer Staples Industry Investment Model versus XLP. This model also passed a backtest I conducted earlier this month.

What Is The Consumer Staples Industry worth?

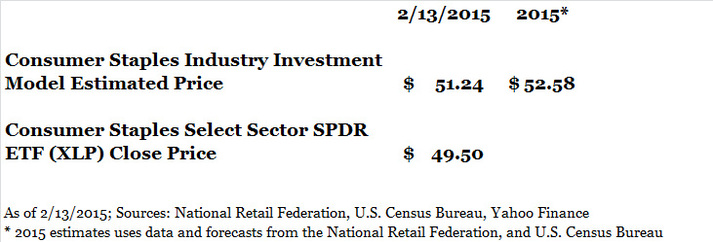

Please see the below chart for the current and 2015 price estimates. I expect the XLP's price to remain roughly the same next year. The consumer staples industry as represented by the SPDR ETF XLP is fully valued.

Please see the below chart for the current and 2015 price estimates. I expect the XLP's price to remain roughly the same next year. The consumer staples industry as represented by the SPDR ETF XLP is fully valued.

Discussion

The National Retail Federation (NRF) announced that 2015 retail sales excluding automobiles, restaurants, and gas stations will rise 4.1%. Despite using the NRF's 2015 estimate for next year, it isn't enough to drive price growth much. Consumer staples relative to other industries is considered mature and slow growing; future growth is likely priced in.

Should I sell?

The Consumer Staples Industry as represented by XLP is fully priced unless you are looking for large share price increases. Investors holding consumer staples companies will continue receiving annual cash dividends of about 2 - 3% of share prices. Consumer staples companies are less risky than the overall stock market and should provide a degree of downside protection.

Prices can improve further if the stock market continues reaching or exceeding new market highs and/or merchant wholesaler inventory levels surge.

Why does surging wholesaler inventory levels help consumer staples companies?

This is a mystery I will explore in a future blog. I have two theories:

The National Retail Federation (NRF) announced that 2015 retail sales excluding automobiles, restaurants, and gas stations will rise 4.1%. Despite using the NRF's 2015 estimate for next year, it isn't enough to drive price growth much. Consumer staples relative to other industries is considered mature and slow growing; future growth is likely priced in.

Should I sell?

The Consumer Staples Industry as represented by XLP is fully priced unless you are looking for large share price increases. Investors holding consumer staples companies will continue receiving annual cash dividends of about 2 - 3% of share prices. Consumer staples companies are less risky than the overall stock market and should provide a degree of downside protection.

Prices can improve further if the stock market continues reaching or exceeding new market highs and/or merchant wholesaler inventory levels surge.

Why does surging wholesaler inventory levels help consumer staples companies?

This is a mystery I will explore in a future blog. I have two theories:

- A rapid increase in the merchant wholesaler inventory indicates excess supply which may reduce COGS for consumer staples retailer gross margins.

- Growing inventories implies higher expectations for future sales growth.

RSS Feed

RSS Feed